Planning for the Future

Many people who have a family member with a learning disability fear what will happen when they are no longer around to care for them.

This Blog covers some of the main things you can think about to help prepare for the future.

Planning for benefits and banking

Planning for benefits and banking

- If you manage the benefits of your relative with a learning disability as their appointee or deputy, it is important to plan for if you are no longer around or not able to get the money out.

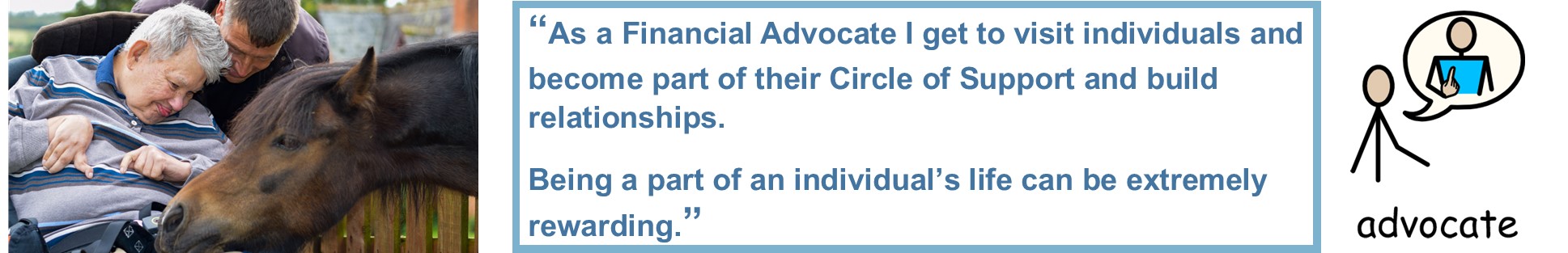

- If you build a financial circle of support for your relative, their future will be more secure as they are not dependent on one person.

- A circle of support could include family, friends, support workers or other people who want to be part of the life of your relative.

- Some charities will support you to build a circle of support. They are listed below so you can find one local to you.

- You should also make sure that key people such as family members and support staff know important money information:

- Which bank are they with?

- How is this money accessed (PIN, signature, appointee)?

- Where are financial documents kept?

- You could also look for other support options, such as a financial advocacy or appointeeship service that could take over in the future.

Planning for financial security

Planning for financial security

- A Will is a written and legally binding document, which tells people what to do with money and property when you die.

- Anyone over 18 can make a Will if they have capacity.

- To have capacity they need to be able to answer ‘yes’ to the following questions:

- Do you know what a Will is?

- Do you know what things belong to you?

- Can you choose who gets your things after you die?

- If someone with a learning disability would like to make a Will, they should get written confirmation of their capacity from a solicitor and a medical professional before they make a Will.

- Wills are legally binding, but that does not mean they cannot be contested. It is important to seek legal advice when writing one.

- As well as a solicitor, you could also get support from an accountant or independent financial advisor.

- Most people never make a Will, but it is important to create one even if you do not have a lot of money.

- If you die without a Will, the law sets out how your assets will be divided (the Intestacy Rules).

- This may not be what you would have chosen.

- For many people, the main objectives of writing a Will are to:

- Name the person (an executor) who will be in charge of making sure your wishes are followed

- Pay off any money you owe

- Provide for your family and decide how you want your estate to be divided

- Create a secure financial future for a relative with a learning disability (a Discretionary Trust, see below)

- Ensure there is a guardian for children under 18

- Avoid delays, conflict or confusion

- You should involve your family and other people who are involved in your life in this process so that you can create a clear plan and help everyone to understand your wishes for the future.

- You should regularly review and update your Will to make sure it is still appropriate to your circumstances.

Creating a Discretionary Trust

- Many people with a learning disability are dependent on means-tested benefits, so they may lose some benefits and have to pay for their care costs if they inherit money directly.

- A Discretionary Trust can provide a structure to manage their money and protect their entitlement.

- A Trust is a legal arrangement set up by a solicitor. It states:

- Who can benefit from it (beneficiaries)

- Who can manage it (trustees)

- What the funds can be used for

- The beneficiaries could be a single relative with a learning disability, your extended family, or even a charity.

- A trustee must look after the assets of the Trust, and must spend the money in the best interests of the beneficiaries and in line with your wishes.

- You need to name at least two trustees in your Will. These should be people that you trust completely, and who are committed to the long-term responsibility of managing the Trust.

Resources and support

- Community Circles is a useful blog with information and advice www.communitycirclesblog.wordpress.com

- Circles Network is a national charity which can provide support in developing a circle of support and advocacy www.circlesnetwork.org.uk

- The Grapevine Help and Connect project specialises in bringing people together and helps people with a learning disability make connections www.grapevinecovandwarks.org

- The Disability Law Service can support you with finding a solicitor with experience of future planning for people with a learning disability www.dls.org.uk

- You can find a solicitor by calling the Law Society on 0870 606 5555 or on their website www.solicitors-online.com

- The Citizens Advice Bureau can advise you about solicitors near you. Call them on 08444 111 444 or visit your local office

- You will probably have to pay your solicitor, but you can get free legal advice with Legal Aid if you are over 70 or have a disability. Find out more by contacting Community Legal Advice on 0345 345 4345 or visit CommunityLegalAdvice.org.uk | Community Legal Advice

Where can I get more information?

Where can I get more information?

- Making a will www.gov.uk/make-will

- Information on trusts www.gov.uk/trusts-taxes

- Contact Dosh to discuss support options for your relative for the future, including financial advocacy and appointeeship for benefits.

Kerry Measures January 20th, 2023

Posted In: News and Blogs, Uncategorized

Being Bettina’s Dad – Being a Carer.

Being Bettina’s Dad – Being a Carer – A blog written by our Managing Director, Steve Raw.

This is Bettina. Bettina copes with autism and a learning disability.

Bettina is our pride and joy.

Dozing on the settee after a hard day’s work my pager started to beep. I woke up and phoned my transport department. They had the call that Joyce was going into labour, and they were sending a vehicle round to our flat to rush me to Berlin Military Hospital (BMH). We were 10 months into a two-year tour of occupied Berlin, and it was still a couple of years before the ‘Wall’ was to come down.

Within a couple of hours our beautiful daughter Bettina had come into our lives. It would be another 18 months before she was diagnosed with severe autism and a learning disability, but that didn’t matter to us (and still doesn’t) she is our beautiful daughter and love is enough. Being Bettina’s Dad: When love is not enough to keep you Safe and Secure – Leadership in the Raw

As I write this article, I have just received an invite from MacIntyre Families @MacFamilies https://www.macintyrecharity.org/ to be interviewed for a podcast. MacIntyre Families work with “all families ,siblings and circles of support to ensure voices are being heard, understood & importantly working together.”

So immediately I started thinking of the answers to potential questions and writing an article I could share which may help other carers and people who have an interest in supporting people.

Joyce and I are super organised and from the moment we got together we started planning. Having two daughters was always the plan, although I must admit that being a parent carer was not in the action plan.

“Most things don’t work out as expected but what happens instead often turns out to be the good stuff” Dame Judi Dench

On reflection, and 35 years of supporting Bettina, Dame Judi was quite right that it does indeed ‘turns out to be the good stuff’. ‘B’ as she is often referred to by her family, has enriched our lives and has taught us on what is important and what really is unimportant.

How has she done this?

Part 1. “Everybody has plans until they get hit for the first time”. Mike Tyson

1992 was not our family’s best year. Both my mum and father-in law passed away within weeks of each other; I had a severe bout of flu at the beginning of the year, and Bettina was permanently excluded from school halfway through her first term!

- “What doesn’t kill you makes you stronger” and those experiences drew us even closer together as a family knowing that we were dependant on each other and meant that we could bounce back and take on the world on behalf of Bettina.

- Money was super-tight at the time, as we had only just bought our first house and the interest rates skyrocketed to 15%, but we managed to find some money for a week in Great Yarmouth, our first holiday as a family – we still reminisce about that holiday – but we have found that when Bettina spends (intensive) time with her family on her hols she progresses at an increased rate, and she certainly did that year.

- With lots of teamwork, perseverance and love we got through 1992. Bettina quickly returned to school under its new leadership and enhanced provision.

Part 2. “Make up your mind that no matter what comes your way, no matter how difficult, no matter how unfair, you will do more than simply survive. You will thrive in spite of it.” —Joel Osteen

We thrived in spite of it:

- Joyce set up a support group for carers which morphed into a Carers Centre which also provided for Young Carers – the most vulnerable of carers.

- In 1996 on retirement from my Army career I started a new career in social care supporting adults with a learning disability. I am still thriving 26 years later as a Managing Director for Dosh dosh.org supporting adults with a learning disability to have more control and independence with their money.

- Over the last 30 years Bettina has brought laughter, fun and joy to her family. We have grown together while always keeping a sense of perspective thanks to ‘B’. I truly think there is nothing we can’t face as a family.

Part 3 – “I believe in being strong when everything seems to be going wrong. I believe that happy girls are the prettiest girls. I believe that tomorrow is another day and I believe in miracles.” Audrey Hepburn

Five fun things we get from being a carer for Bettina:

- As Bettina does not appear to have any concept of age both, Joyce and I are expected to function at the same energy level we did 30 years ago. I live a completely different life to the one my parents did at the age I am now.

- While Bettina’s verbal communication is limited, she does astound us sometimes with her opinions when she suddenly joins in the conversation at the dinner table. This often happens when I am pontificating about something. Bettina suddenly comments “I don’t care” which has us all falling about with laughter. A side eye from ‘B’ tells us she meant it.

- Bettina’s sayings and phrases are unique to her (‘B’ often creates new ones too) and she often expresses them in public – we know what they mean but fortunately the general public do not!

- Bettina gets us out of social engagements we don’t want to be part of. No extended family on Christmas day for us. “Bettina needs calm and quiet”

- Bettina helps us find and hold on to our “inner child” too easily lost when you become an adult: Being Bettina’s Dad: Finding your inner child and not forgetting to lose it – Leadership in the Raw

A quote for Bettina’s family and all carers:

“When written in Chinese the word “crisis” is composed of two characters – one represents danger and the other represents opportunity.”

Thank you, Bettina, for giving us a lifetime of opportunities.

Bettina with her big sister, Jennifer, and her dad.

Woolacombe Beach 2022

Picture courtesy of Joyce Raw (‘B’s tiger mum)

Kerry Measures July 27th, 2022

Posted In: News and Blogs, Uncategorized