Planning for the Future

Many people who have a family member with a learning disability fear what will happen when they are no longer around to care for them.

This Blog covers some of the main things you can think about to help prepare for the future.

Planning for benefits and banking

Planning for benefits and banking

- If you manage the benefits of your relative with a learning disability as their appointee or deputy, it is important to plan for if you are no longer around or not able to get the money out.

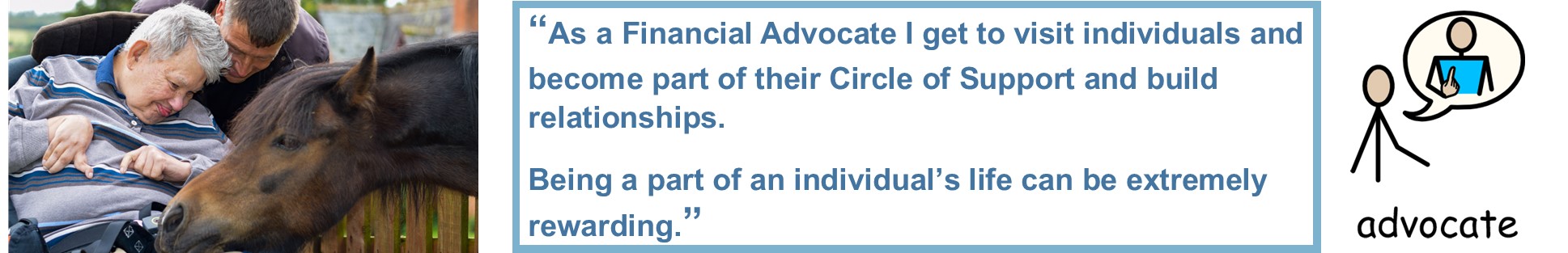

- If you build a financial circle of support for your relative, their future will be more secure as they are not dependent on one person.

- A circle of support could include family, friends, support workers or other people who want to be part of the life of your relative.

- Some charities will support you to build a circle of support. They are listed below so you can find one local to you.

- You should also make sure that key people such as family members and support staff know important money information:

- Which bank are they with?

- How is this money accessed (PIN, signature, appointee)?

- Where are financial documents kept?

- You could also look for other support options, such as a financial advocacy or appointeeship service that could take over in the future.

Planning for financial security

Planning for financial security

- A Will is a written and legally binding document, which tells people what to do with money and property when you die.

- Anyone over 18 can make a Will if they have capacity.

- To have capacity they need to be able to answer ‘yes’ to the following questions:

- Do you know what a Will is?

- Do you know what things belong to you?

- Can you choose who gets your things after you die?

- If someone with a learning disability would like to make a Will, they should get written confirmation of their capacity from a solicitor and a medical professional before they make a Will.

- Wills are legally binding, but that does not mean they cannot be contested. It is important to seek legal advice when writing one.

- As well as a solicitor, you could also get support from an accountant or independent financial advisor.

- Most people never make a Will, but it is important to create one even if you do not have a lot of money.

- If you die without a Will, the law sets out how your assets will be divided (the Intestacy Rules).

- This may not be what you would have chosen.

- For many people, the main objectives of writing a Will are to:

- Name the person (an executor) who will be in charge of making sure your wishes are followed

- Pay off any money you owe

- Provide for your family and decide how you want your estate to be divided

- Create a secure financial future for a relative with a learning disability (a Discretionary Trust, see below)

- Ensure there is a guardian for children under 18

- Avoid delays, conflict or confusion

- You should involve your family and other people who are involved in your life in this process so that you can create a clear plan and help everyone to understand your wishes for the future.

- You should regularly review and update your Will to make sure it is still appropriate to your circumstances.

Creating a Discretionary Trust

- Many people with a learning disability are dependent on means-tested benefits, so they may lose some benefits and have to pay for their care costs if they inherit money directly.

- A Discretionary Trust can provide a structure to manage their money and protect their entitlement.

- A Trust is a legal arrangement set up by a solicitor. It states:

- Who can benefit from it (beneficiaries)

- Who can manage it (trustees)

- What the funds can be used for

- The beneficiaries could be a single relative with a learning disability, your extended family, or even a charity.

- A trustee must look after the assets of the Trust, and must spend the money in the best interests of the beneficiaries and in line with your wishes.

- You need to name at least two trustees in your Will. These should be people that you trust completely, and who are committed to the long-term responsibility of managing the Trust.

Resources and support

- Community Circles is a useful blog with information and advice www.communitycirclesblog.wordpress.com

- Circles Network is a national charity which can provide support in developing a circle of support and advocacy www.circlesnetwork.org.uk

- The Grapevine Help and Connect project specialises in bringing people together and helps people with a learning disability make connections www.grapevinecovandwarks.org

- The Disability Law Service can support you with finding a solicitor with experience of future planning for people with a learning disability www.dls.org.uk

- You can find a solicitor by calling the Law Society on 0870 606 5555 or on their website www.solicitors-online.com

- The Citizens Advice Bureau can advise you about solicitors near you. Call them on 08444 111 444 or visit your local office

- You will probably have to pay your solicitor, but you can get free legal advice with Legal Aid if you are over 70 or have a disability. Find out more by contacting Community Legal Advice on 0345 345 4345 or visit CommunityLegalAdvice.org.uk | Community Legal Advice

Where can I get more information?

Where can I get more information?

- Making a will www.gov.uk/make-will

- Information on trusts www.gov.uk/trusts-taxes

- Contact Dosh to discuss support options for your relative for the future, including financial advocacy and appointeeship for benefits.